Pure Storage, Inc PSTG is scheduled to report second-quarter fiscal 2024 results on Aug 30.

For the fiscal second quarter, management anticipates total revenues to be $680 million, indicating year-over-year growth of 5%. The Zacks Consensus Estimate is pegged at $681.3 million, suggesting an increase of 5.3% on a year-over-year basis.

The Zacks Consensus Estimate for earnings is pegged at 28 cents per share. The company reported earnings of 32 cents in the prior-year quarter.

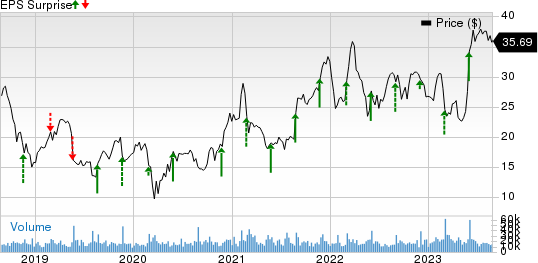

Pure Storage, Inc. Price and EPS Surprise

Pure Storage, Inc. price-eps-surprise | Pure Storage, Inc. Quote

PSTG beat estimates in each of the last four quarters, the average surprise being 50.2%.

Shares of Pure Storage have gained 17.5% in the past year against the sub-industry's decline of 28.3%.

Image Source: Zacks Investment Research

Factors to Note

Continued momentum in its subscription services, namely Pure as-a-Service subscription (including Cloud Block Store), Portworx and Evergreen Storage, is likely to have boosted Pure Storage’s fiscal second-quarter performance. We expect revenues from subscription services to be $259.1 million for the fiscal second quarter.

The company is well-positioned to gain from the ongoing data explosion. PSTG is witnessing continued strength for FlashArray//C owing to its portability, efficiency and reliability over traditional storage systems. This, in turn, is likely to have strengthened the top line in the to-be-reported quarter. Also, healthy adoption of Evergreen//One and Evergreen//Flex bodes well.

Pure Storage continues to invest heavily in research and development to launch new products as well as enhance existing product lines. In Jun 2023, management announced the launch of its FlashArray//E, to further expand its disk replacement-focused Pure//E family. It will help customers to reduce costs and e-waste. It also introduced FlashArray//X and FlashArray//C R4 models to help customers accentuate performance for business-critical workloads and reduce costs.

An expanded customer base (especially large enterprise clients) along with strength in commercial business bodes well. In the last reported quarter, PSTG added more than 276 customers. The company has more than 11,500 customers and represents 58% of Fortune 500 companies.

However, weakness in global macroeconomic conditions and cutback in spending by clients are likely to affect the company’s performance in the to-be-reported quarter. Unfavorable forex movements, volatile supply-chain dynamics and inflation are likely to have acted as added headwinds.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. This is not the case here.

Pure Storage has an Earnings ESP of 0.00% and a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

Here are some stocks that you may consider as our model shows that these have the right combination of elements to beat on earnings this season.

Five Below FIVE has an Earnings ESP of +1.21% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Five Below is set to release second-quarter fiscal 2023 results on Aug 30. The Zacks Consensus Estimate for earnings is pegged at 83 cents per share, suggesting an increase of 12.2% from the prior-year quarter’s reported figure. Shares of FIVE have gained 37.7% in the past year.

Ollie's Bargain Outlet Holdings, Inc OLLI has an Earnings ESP of +6.12% and a Zacks Rank of 2 at present.

Ollie's Bargain Outlet Holdings is slated to report second-quarter fiscal 2023 numbers on Aug 31. The Zacks Consensus Estimate for earnings is pegged at 61 cents per share, indicating a surge of 177.3% from the previous-year quarter’s levels. Shares of OLLI gained 16% in the past year.

Lululemon Athletica Inc LULU has an Earnings ESP of +1.05% and a Zacks Rank of 3.

Lululemon Athletica is scheduled to post second-quarter fiscal 2023 figures on Aug 31. The Zacks Consensus Estimate for earnings is pegged at $2.53 per share, implying 15% rise from the year-ago quarter’s levels. Shares of LULU have increased 15.7% in the past year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

"pure" - Google News

August 25, 2023 at 05:59PM

https://ift.tt/ons0HFB

Pure Storage (PSTG) to Report Q2 Earnings: What's in Store? - Yahoo Finance

"pure" - Google News

https://ift.tt/EbHdmNC

https://ift.tt/IFOLqZK

Bagikan Berita Ini

0 Response to "Pure Storage (PSTG) to Report Q2 Earnings: What's in Store? - Yahoo Finance"

Post a Comment