Pure Storage has reported growing quarterly earnings that shrugged off the initial impact of the COVID-19 pandemic, but it thinks next quarter will be flat.

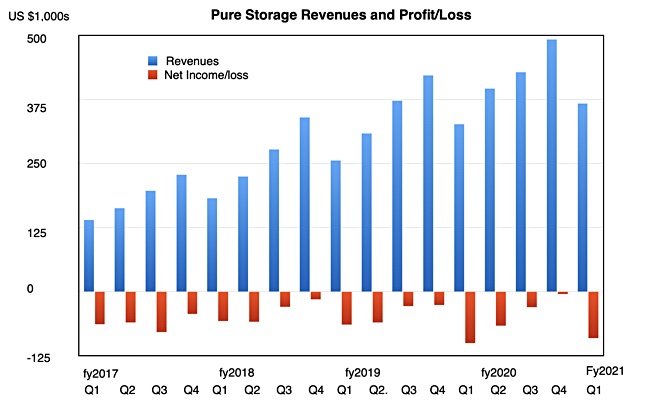

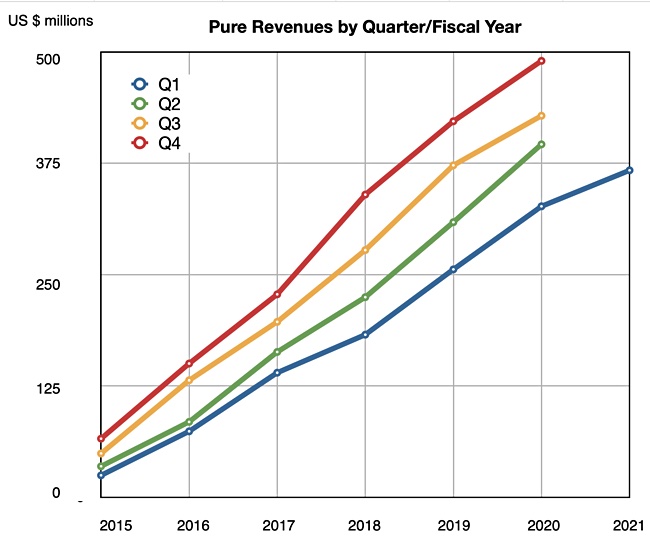

Revenues in the all-flash array vendor’s first fiscal 2021 quarter ended March 31 were up 12 per cent at $367.1m, and the the company made a loss of -$90.6m, compared with -$100.3m last year. Pure said customers needed more mission-critical IT due to the pandemic and this had benefitted the business.

CEO and chairman Charlie Giancarlo provided a quote: “We are extremely proud of this quarter’s solid results and growth, especially during the current global crisis.”

He added: “I contracted covid-19 in March and that experience has provided me with a deep personal appreciation for this virus and its impact.”

Financial summary;

- Subscription Services revenue $120.2 million, up 37% year-over-year

- GAAP gross margin 70%; non-GAAP gross margin 71.9%

- Operating cash flow was $35.1m, up $28.5myear-over-year

- Free cash flow was $11.3m, up $29million year-over-year

- Total cash and investments of $1.27bn

- Total headcount c3,500 compared to 3,400 at the end of fy2020 and 3,150 at the end of Q1 a year ago.

Product strength

Product revenues were $246.9m, up 3 per cent, and subscription revenues climbed 37 per cent to $120.2m. Pure said US enterprise and government business held up well but noted some weakness in its general commercial sector. Pure said it experienced zero impact on its supply chain from the pandemic and was able to work round issues that came up.

The company said the FlashArray//C array, launched in September last year with QLC (4bits/cell) NAND, is its fastest-growing product.

The FlashBlade line accounted for 15 per cent of total revenues ($55.1m), with nearly 10 customers spending more than a million bucks on the product since launch. Giancarlo said: “We’re very excited about the product going forward and expect continued growth.” This implies that all three main products are doing well.

Pure sees increasing demand for public cloud-based IT and claims its Pure-as-a-Service enables customers to move from an on-premises Pure environment to a public cloud with no difficulty. Giancarlo said: “It’s the same exact software and same interface to the application environment, in the cloud, as it is on-prem and that makes their ability to migrate their applications even easier.”

Pure announced that cloud-based workflow automation business ServiceNow has become a customer, using Pure for applications including Splunk, Elastic’s ELK stack, artificial intelligence (AI), and machine learning (ML). It is using Pure’s FlashArray//X and //C and FlashBlade arrays with Pure1 management.

Pandemic effects

The company said it had not laid off or furloughed any employees and did not intend to do so.

Pure added 300 customers in the quarter. Not that high a number – it was 500 the previous quarter – but not that low either. The company attributed this in part to the weakness in its commercial market and also to Pure’s push for more enterprise-class customers. In the earnings call, Giancarlo said: “The lower numbers are a mix of those two things.”

He said: “There is a general risk aversion out there in the market, whether it’s new products, new features, new vendors and that’s going to be with us for a quarter or two until I think the customers have started being able to feel comfortable in putting time into testing.“

On that account Pure is not issuing any formal earnings guidance for the next quarter but suggests that revenues may be flat.

Competition

Pure’s main competitor is Dell, which this month launched its PowerStore midrange array, unifying the prior SC, Unity, VNX and XtremIO product lines.

Giancarlo commented: “Our view very simply is it opens up opportunity to replace four products. Whenever there’s a disruptive upgrade and God loves them … it opens up the opportunity to all vendors, all new vendors, because the customer is going to go through that trouble. It’s basically a brand new product. And in this case, it’s a brand new 1.0 product.”

He thinks: “This is a terrible time to come out with a new 1.0 product. Customers are risk adverse. So we really see this as a great opportunity for us.”

NetApp, another competitor, this week reported its results for the first quarter of 2020. All-flash array revenues were $656m, so Pure has some way to go to reach that level with its current $246.9m all-flash product sales

Giancarlo’s view of Pure’s prospects? “We will continue to take market share.”

"pure" - Google News

May 29, 2020 at 03:59PM

https://ift.tt/3gC7Z2C

Pure earnings beats pandemic, CEO recovers from covid-19 - Blocks and Files

"pure" - Google News

https://ift.tt/3d6cIXO

https://ift.tt/35ryK4M

Bagikan Berita Ini

0 Response to "Pure earnings beats pandemic, CEO recovers from covid-19 - Blocks and Files"

Post a Comment