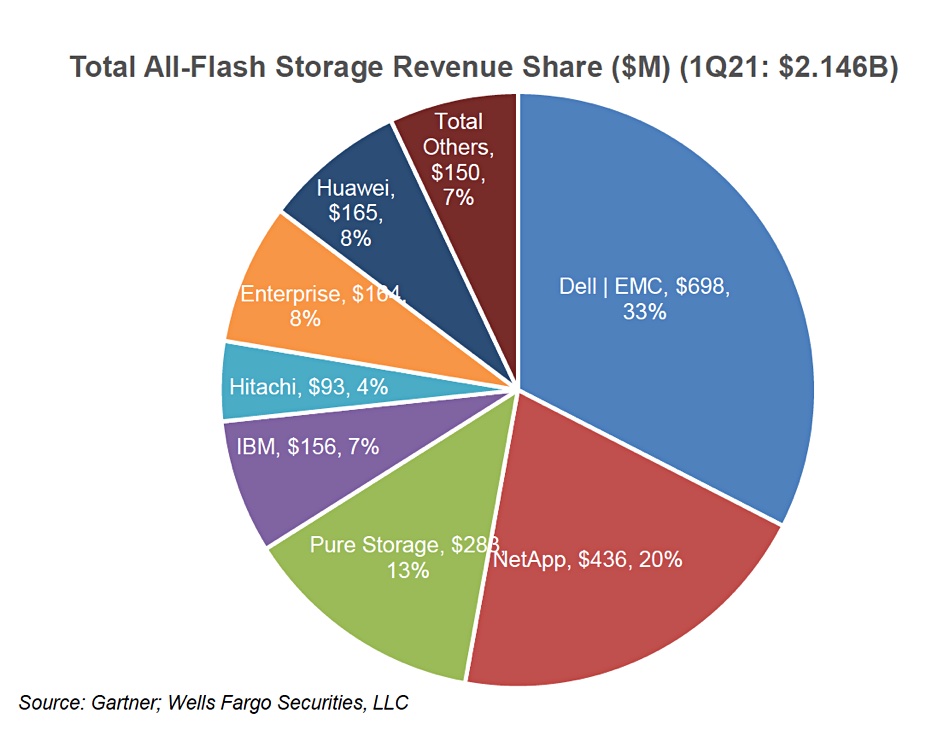

Gartner Research data for the first quarter of 2021 puts Pure Storage in third place in the all-flash array market, behind only Dell and NetApp.

Wells Fargo analyst Aaron Rakers provided a summary of the Gartner data to subscribers and included this chart:

Pure started selling its FlashArray all-flash array product in 2012 and, nine years later, has grown its sales to overtake incumbent external storage suppliers such as HPE, Hitachi Vantara and IBM in all-flash array sales.

Rakers supplied some individual supplier notes:

- Dell Technologies — 32.5 per cent of AFA market, down from 35 per cent a year ago. Its AFA revenue, at $698M, declined nine per cent year-on-year;

- NetApp — 20.3 per cent revenue share with $436M, up two per cent year-on-year. A year ago NetApp’s AFA market share was 19.3 per cent;

- Pure Storage — 13.2 per cent revenue share, up 0.5 per cent from 12.7 per cent a year ago. Actual revenue of $283.5M was up one per cent year-on-year;

- HPE — 7.6 per cent revenue share was down from 8.5 per cent a year ago with revenue $164M, down eight per cent year-on-year;

- Huawei — 7.7 per cent market share, up from the year-ago six per cent. AFA revenues were $165M, up 26 per cent year-on-year;

- IBM — 7 per cent market share with $156M;

- Hitachi Vantara — 4 per cent market share at $93M.

There were also general storage market notes:

- All-flash storage revenue declined 2.4 per cent year-on-year;

- HDD/hybrid storage market declined 1.9 per cent;

- Total capacity shipped in the quarter — 12.1EB — increased ten per cent year-on-year,

- Primary storage sales went down five per cent year-on-year;

- Secondary storage sales rose two per cent;

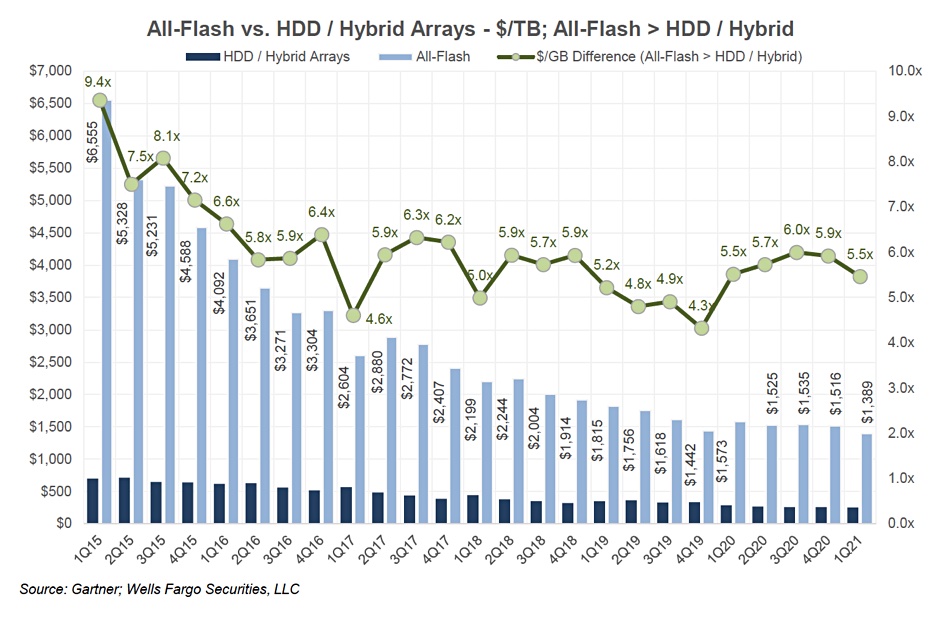

- Flash premium over HDD was 5.5x with a chart showing this was higher than previously.

The pricing trends apparent from this chart do not indicate that the flash premium is going to dip below four per cent any time soon. It seems to Blocks & Files that the largest remaining growth opportunity for all-flash arrays is in the fast-access, secondary storage market, with QLC (4 bits/cell) flash replacing disk drives. The relatively stable flash premium over disk drives of 5x to 5.7x since 2018 is probably discouraging this replacement trend.

"pure" - Google News

June 28, 2021 at 08:24PM

https://ift.tt/361e4Sd

Gartner gives Pure number-3 spot in all-flash arrays — ahead of IBM and HPE – Blocks and Files - Blocks and Files

"pure" - Google News

https://ift.tt/3d6cIXO

https://ift.tt/35ryK4M

Bagikan Berita Ini

0 Response to "Gartner gives Pure number-3 spot in all-flash arrays — ahead of IBM and HPE – Blocks and Files - Blocks and Files"

Post a Comment